Definition: ‘Perpetual Swap’ also known as a ‘Perpetual Futures

Contract’, is an agreement that allows counter-parties to

non-optionally trade an asset (e.g bitcoin) without having to

own it and at any point in the future.

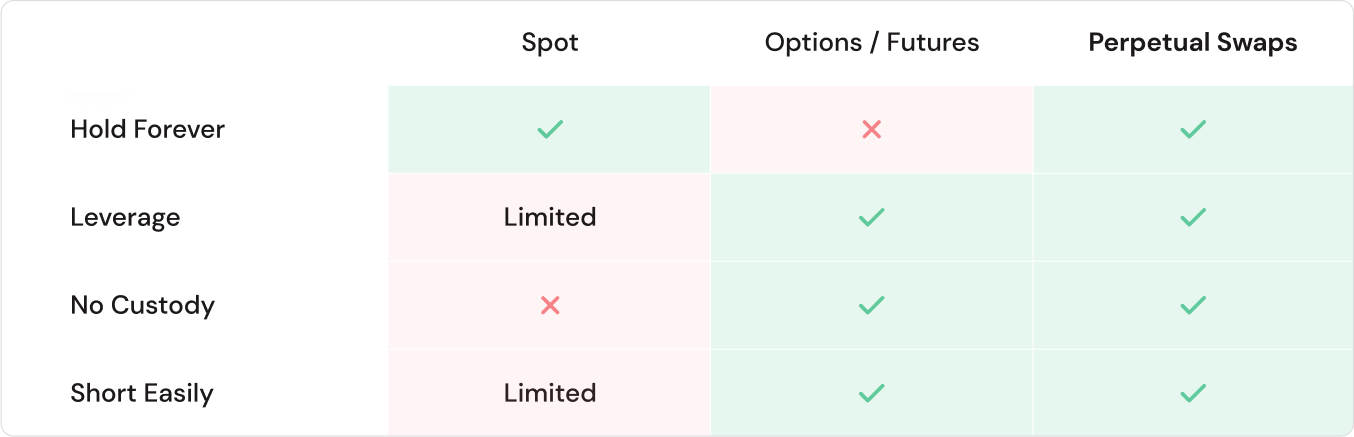

In other words, Perpetual swaps allow for buying or selling the

value of some “underlying” asset with several key advantages:

- Trading with leverage is permitted.

- No custody of the underlying asset is necessary.

- The position can be open forever.

- Shorting is easy.

Perpetuals, like other financial derivatives such as options, forwards, and futures, depend in some way on the value of an agreed-upon underlying financial asset. While perpetuals have long been theoretically proposed in TradFi, they have become the backbone of the crypto derivatives trading market.

History and Present

Perpetuals were first proposed in 1992 by Nobel laureate Robert Shiller as a mechanism for the price discovery of illiquid assets[1]. Since BitMex introduced them in 2016, perpetuals markets for cryptocurrencies have flourished.

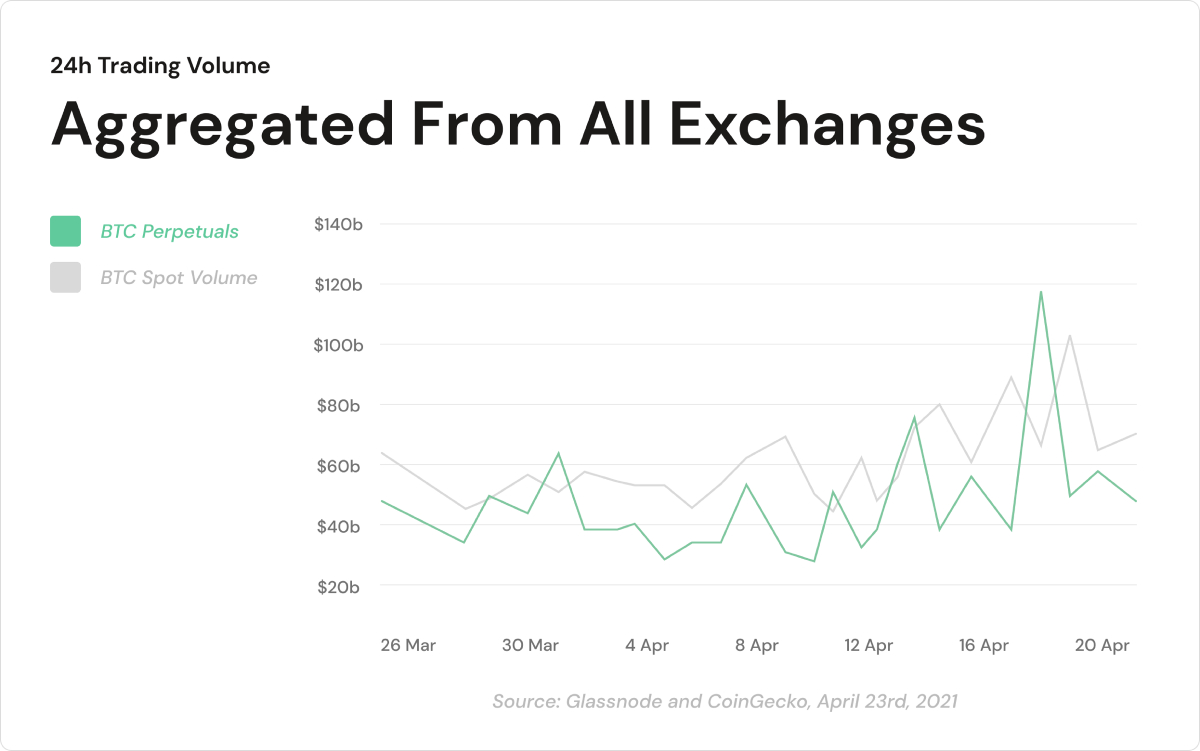

The average daily trading volume on perpetual swaps for Bitcoin is now higher than its spot counterpart [2]. Thanks to their unique characteristics, perpetual swaps are an effective and capital-efficient instrument for traders to bet on the price movements of underlying assets. This article will review the basics of trading perpetual swaps and illustrate how these increasingly popular derivatives work under the hood.

tl;dr

Alice, a cryptocurrency trader, believes that DOT is undervalued and has long-term growth potential. She has several ways to bet on the price of DOT increasing in the future. One way would be to buy DOT in the spot market at the quoted exchange rate, immediately take ownership of the coins, and either hold them or bond them for extra rewards. Or Alice could go to the derivatives market and buy futures or options contracts for DOT. These contracts do not transfer ownership of the coins to Alice, but they allow her to use leverage to increase her “buying power”. Optimally, to benefit from the advantages of derivatives but abstract the complexity of expiration dates associated with futures and options markets, Alice could use the cryptocurrency market’s favorite derivative, the perpetual swap.

Perpetual Swaps vs Options/Futures

Unlike futures contracts, perpetual swaps don’t need to be periodically rolled over to maintain one’s exposure to a position. Traders can hold perpetual swaps for as long as they wish, provided that sufficient collateral, called margin, is maintained to keep their positions open. Furthermore, leverage trading, that is trading with borrowed money, is also supported. Some exchanges even offer up to 125x leverage (!). Dissecting leverage necessitates a discussion of margin ratios, liquidations, and insurance funds, for which we will reserve a separate article.

Perpetual Swaps vs Spot

In contrast to the spot markets in Perpetual swaps, no exchange of the underlying assets occurs. Traders gain long or short-price exposure without the hassle of custody of the investment. Lastly, the price of a perpetual swap closely tracks the price of an underlying asset through periodic funding payments exchanged between holders of long and short contracts. The funding rate mechanism is discussed in detail here. In brief, it balances the demand for long and short contracts. The funding payments converge the price of a perpetual swap to the spot price of the underlying asset.

Considering their advantages, it is not surprising that perpetual swaps have become the most popular cryptocurrency derivative.

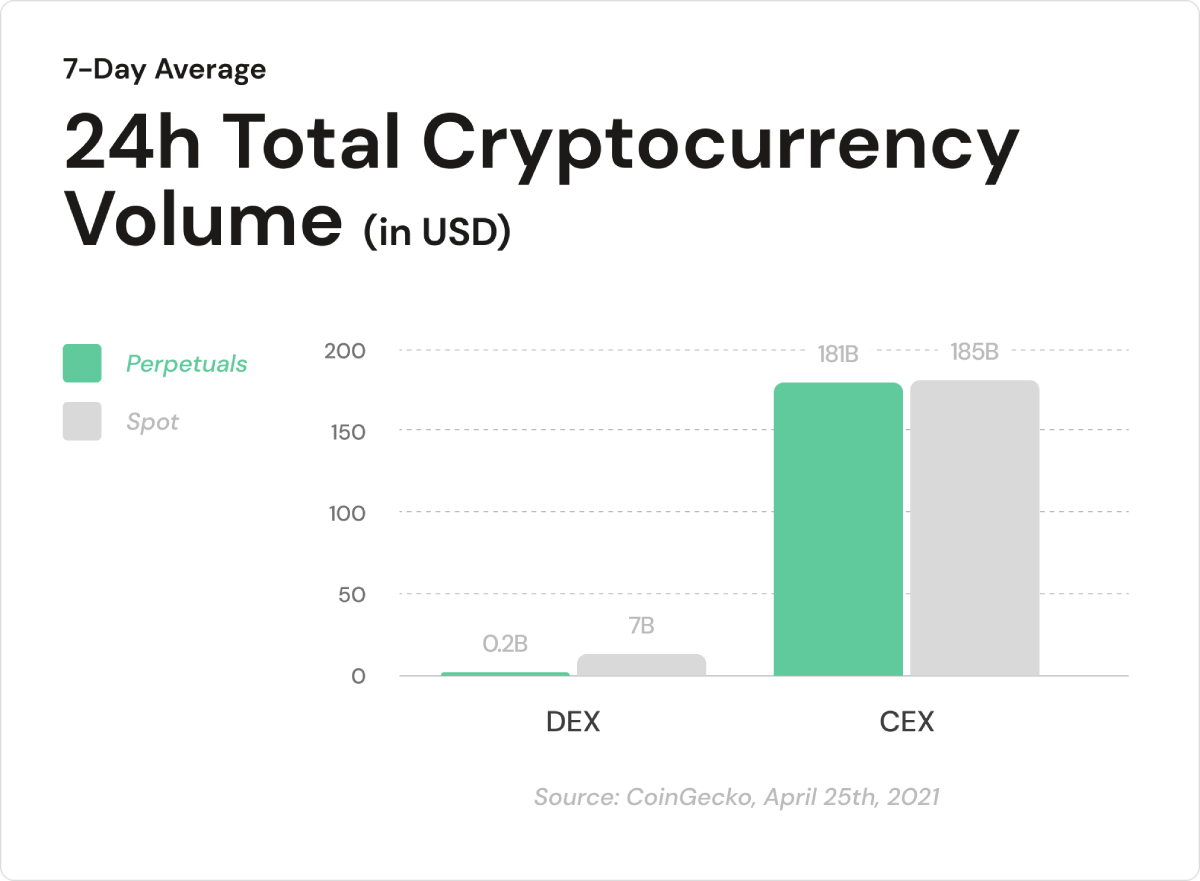

CeFi on Top, DeFi Rising

The cryptocurrency market for perpetual swaps experiences higher trading volumes than spot markets and has an increasingly significant impact on the prices of crypto assets. Centralized exchanges, such as Binance, Huobi, Bybit, and FTX, dominate the space, with decentralized exchanges capturing less than 1% of centralized exchange trading volume at the time of writing. In February, the average daily volume on four leading perpetual swap DEXs was 67.7M USD, compared to that of 137B USD on CEXs [3]. Three months later, the average daily trading volume for perpetual swaps on the same DEXs is up almost 300%, with that on CEXs up by 32%. On top of deep liquidity, a smooth user experience, and performant on-chain transaction settlement, decentralized exchanges will need to attract traders with economic incentives and value distribution models better than those on centralized exchanges.

How ‘Perpetual Swaps’ trading works

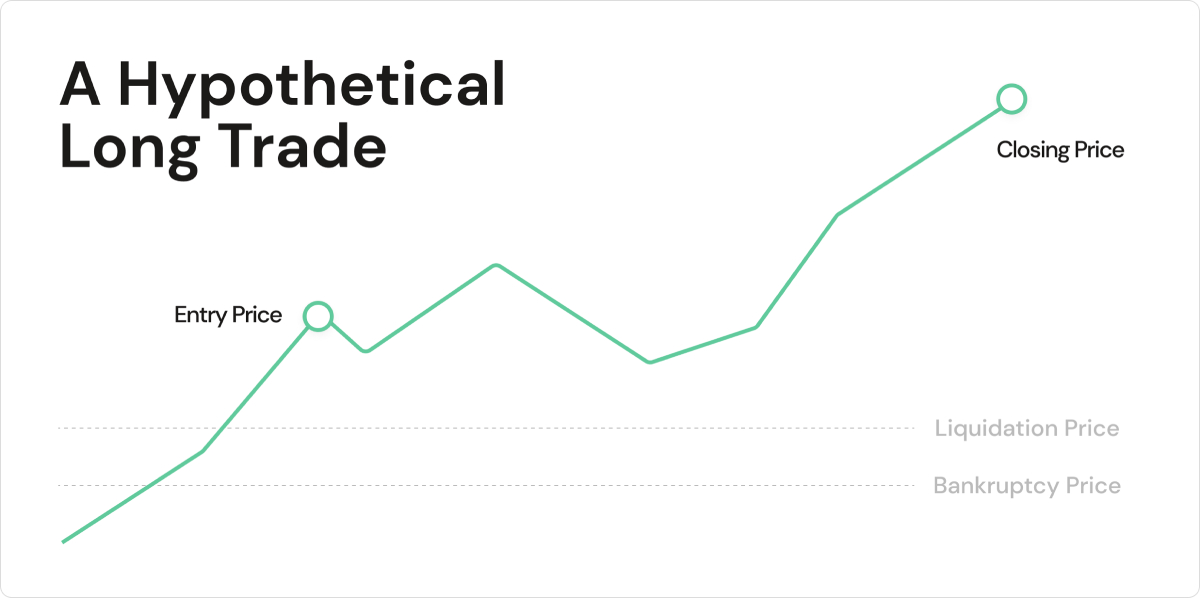

To open a perpetual swap position, a trader must first deposit some assets, typically USD or stablecoins, as collateral. After choosing the desired leverage, a trader opens a long or short position depending on whether they believe the asset will appreciate or depreciate. Four prices are relevant to every leveraged trade:

- Entry price: the average price per contract at which the perpetual swap trade is opened.

- Bankruptcy price: the price per contract at which the loss on the trade is equal to the collateral value.

- Liquidation price: The price per contract at which the liquidation occurs. It is slightly higher than the bankruptcy price for a long position and lower than the bankruptcy price for a short position.

- Closing price: the average price per contract at which the trade is closed.

For a long trade, the prices can be visualized this way:

Example of a long trade in Perpetual Swaps

On February 1st 2021, Bob opens up his phone and sees that DOT

is trading at 20 USD. He believes that the price of DOT will be

higher in the future and decides to use a perpetual swap

contract to express this belief in the market. Bob deposits 100

USDC to a derivatives exchange and enters a long position on 4x

leverage for 20 DOT contracts, worth 400 USDC in total. His

entry price is 20 USDC per contract. In effect, Bob achieved

price exposure to 20 DOT, with only 25% of the position value in

collateral! Leverage is a double-edged sword, though. It is

enough for the price of DOT to decrease by 25% for Bob to lose

the entire 100 USDC collateral.

Entry price: 20 USDC; Leverage: 4x

Bankruptcy price =

Entry price x (1 - 1/Leverage) = 15 USDC

Fortunately for Bob, the price of DOT steadily increases over the following days. He is satisfied with the outcome and sells his 20 DOT contracts at a closing price of 30 USDC two weeks later.

Bob’s profit = no. of contracts * (Entry price — Closing

price)

Bob’s profit = 20 * (30 USDC — 20 USDC) = 200

USDC

Ignoring the effect of the funding payments, Bob exits at a nice profit of 200 USDC. Ultimately, he made a profit of 200% on his USDC while the price of DOT increased by 50%.

How does ‘Leverage’ work in derivatives trading?

Trading with leverage involves borrowing capital to increase the price exposure and magnify the profits and losses. The initial deposit, called collateral or initial margin, is used to open a more sizable trade. The ratio of the initial trade value to the margin is called leverage. For example, a trader using 4x leverage can trade contracts worth 400 USD with only a 100 USD margin.

When trading with leverage, traders must be aware of the maintenance margin and the liquidation price. All positions are opened with an initial margin as collateral. When unrealized losses reduce the initial margin to the point where only the maintenance margin remains, the position is liquidated. This means that the exchange closes the position, and the trader loses the initial margin assigned to the position. If possible, liquidations should be avoided by adding collateral. We wrote about margin requirements, insurance funds, and auto-deleveraging in another article.

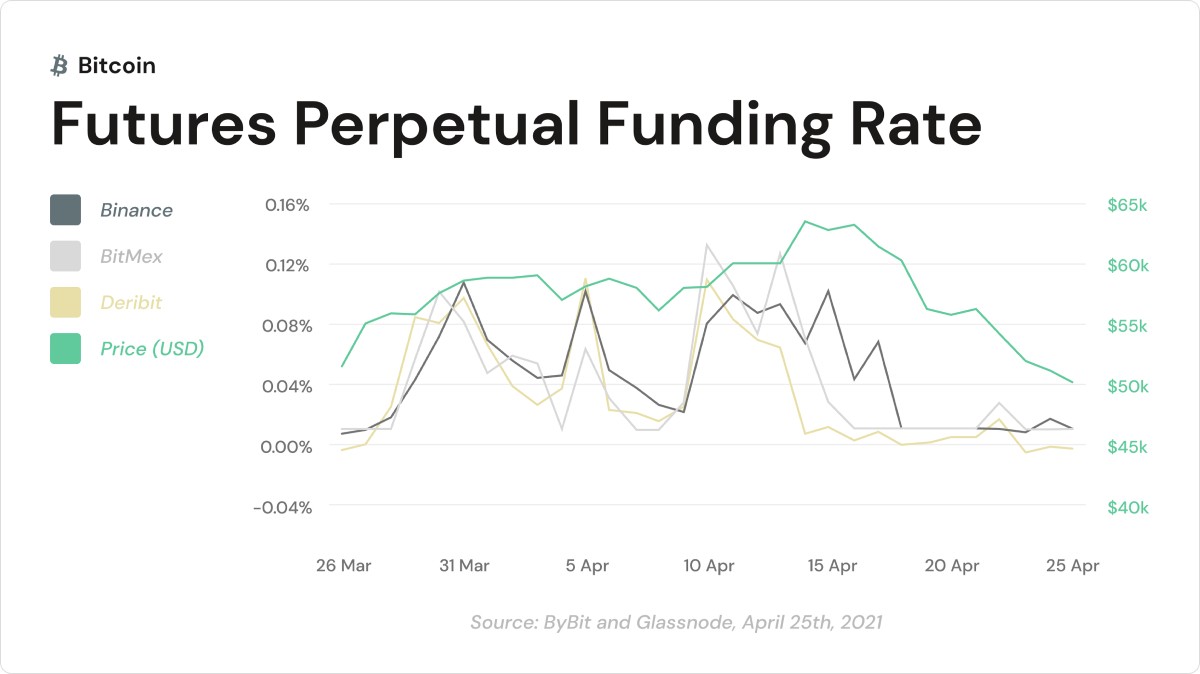

Funding Rates: How Perpetuals Track the Underlying’s Price

The funding rate is an equilibrating mechanism which corrects the contract’s price to the underlying’s price. Funding rates put a price on deviations of the perpetual’s price from the underlying asset’s price. The larger the divergence, the higher the funding rate. The methodology for calculating funding payments varies widely across exchanges. Still, the funding rate typically has two components: the interest component and the premium component [4].

Funding Rate = Interest Rate Component + Premium

component

The interest rate component is usually set to account for the difference in interest rates of the base and quote currencies. The premium component is calculated algorithmically, depending on the index price and impact bid/ask prices. Let’s break that down.

Index Price: the instantaneous fair market price of the underlying spot asset (e.g. BTC for BTC perpetual). For decentralized exchanges, the index price is provided on the blockchain directly (oracle).

Impact Bid/Ask Price: bid/ask impact prices are the average execution prices for market sell/buy orders of predetermined “impact” notional value. For example, for an impact notional value of 10000 USD, the impact bid price would be the average price to market sell 10000 USD worth of contracts. The notional values used for impact prices vary across exchanges, and depend on the liquidity of the exchange.

Then, the premium component of the funding rate is calculated as the deviation of the impact price on the exchange from the index price in proportion to the index price.

Premium Component = (Max(0, Impact Bid Price - Index Price) -

Max(0,

Index Price - Impact Ask Price)) / Index Price

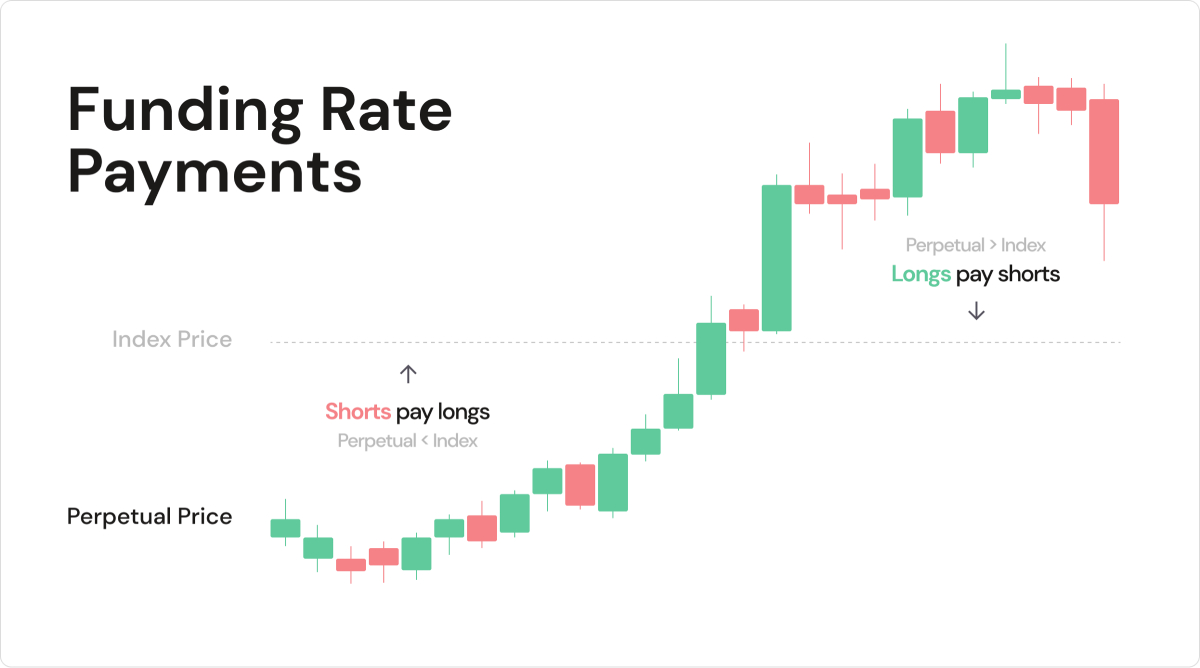

Intuitively, if longs are more in demand than shorts, the time-averaged impact ask prices will deviate further from the index price than the impact bid prices. This will make the premium component temporarily favor short position holders. Then, the funding rate is positive, and longs periodically make funding payments to shorts. The same is true in reverse. If the impact price is on average lower than the index price, shorts pay longs. Thanks to the funding payments and price arbitrage, the price of the perp converges with the price of the underlying asset.

These payments are exchanged continuously or periodically, for

example, every one hour. Traders receive or make funding

payments in proportion to the notional value of their open

positions, i.e.,Position Value * Funding Rate.

Thus, traders holding significantly leveraged positions will pay

or receive a larger payment relative to their collateral. The

funding rate is calculated differently by different exchanges.

The graphic below shows funding rates on a few large exchanges

for perpetuals in the last 30 days.

Funding payments are exchanged between traders, the exchange does not pay or receive anything.

Collateral Types and PnL

The way profit and loss is calculated is the difference between the closing price and the open price when a perpetual swap contract is closed, taking into account both trading direction and position size. There are two types of settlement: inverse non-linear and linear.

Inverse, non-linear settlement involves collateralization and payout in the base currency, rather than the quote currency. For example, traders on the BTC/USD pair, deposit BTC as collateral and receive their payout in BTC. The non-linearity arrises because the value of both the BTC collateral and the contract changes when the price of BTC moves. As a trader profits from a long position in BTC, a trader receives a BTC payout, but in a smaller amount since BTC itself is more expensive relative to USD. Conversely, if BTC/USD drops in value, the trader will also be losing BTC at a faster rate since BTC itself is cheaper relative to USD. Furthermore, liquidation risk is higher as the value of the BTC collateral posted goes down as BTC/USD goes down.

Linear settlement is often more intuitive and newer than inverse settlement. Traders collateralize their contracts with stablecoins and are paid in stablecoins when closing positions. In this way, the value of the collateral stays stable as the value of the contract changes.

Conclusion

Perpetual swaps represent the right to buy or sell an underlying asset at any point in the future. Perpetual swaps are a powerful tool for traders who want to profit from an asset’s price changes without holding the asset itself. Not owning the underlying asset, however, implies losing the opportunity to stake or lend it. Moreover, leveraged trading requires careful considerations of desired risk exposure. Ultimately, the availability of high leverage made perpetual swaps the most traded cryptocurrency instrument by volume.

Currently, the perpetual swap market is dominated by centralized exchanges. Decentralized perpetual swap platforms take up less than 1% of the market compared to centralized solutions. Ultimately, decentralized exchanges offer a better value proposition to traders. Most decentralized exchanges distribute the revenue they generate to the exchange users, e.g., to the liquidity providers on Uniswap. Fair revenue distribution models, common to DeFi, allow users to profit directly from the long-term adoption of the exchange.

Bibliography

[1] Shiller, Robert J. “Measuring Asset Values for Cash Settlement in Derivative Markets: Hedonic Repeated Measures Indices and Perpetual Futures.” The Journal of Finance 48, no. 3 (1993): 911–31. doi:10.2307/2329020.

[2] “Bitcoin USD Historical Data | Coingecko”. 2021.

Coingecko.

https://www.coingecko.com/en/coins/bitcoin/historical_data/usd#panel.,

[3] “Analysis Of Decentralized Perpetual Swaps”. 2021.

Medium.

https://huobi-defilabs.medium.com/analysis-of-decentralized-perpetual-swaps-a23ec8488a60

[4] “Perpetual Funding Rate”. 2021.dYdX.

https://help.dydx.exchange/en/articles/4797443-perpetual-funding-rate

- Bluefin

Website:

https://bluefin.io

Exchange:

https://trade.bluefin.io/

Twitter:

https://twitter.com/bluefinapp

Telegram:

https://t.me/bluefinapp