Key Takeaways

- Timeline: Bluefin v2 will be released in a beta state in September followed by several features that include instant trade confirmations, sub-second finality, fully-decentralized spot markets, cross-margin, and trading without wallets. These will be rolled out over the next six months.

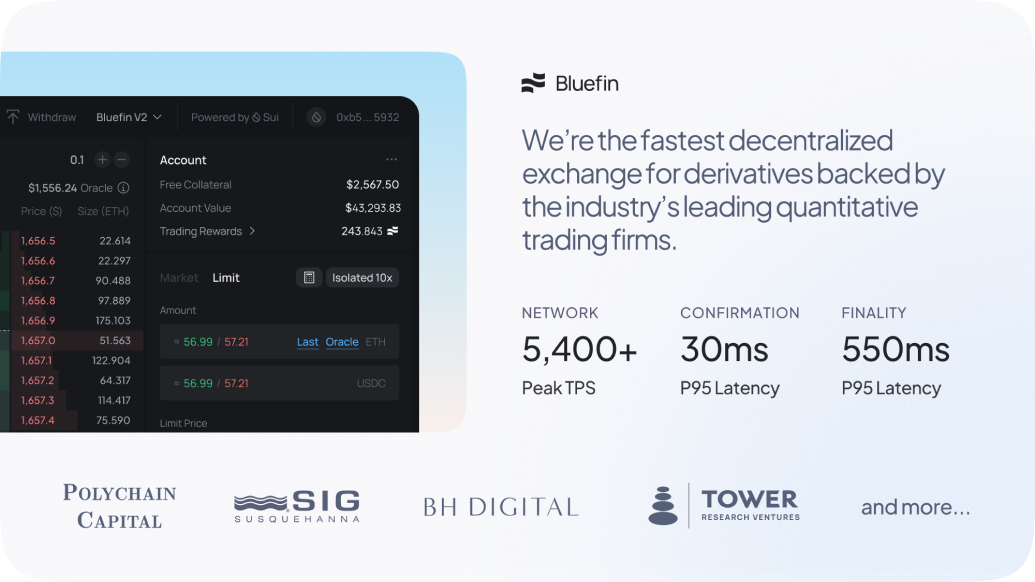

- Performance: ~30ms optimistic trade confirmations, ~550ms finality, 5,400+ peak TPS

- Eliminating Wallets: We’re working to emulate the Web2 trading experience while retaining the decentralization benefits of an on-chain trading protocol

- Cost of Execution: The spread on Bluefin v1 is currently <0.001% and with reduced latencies and gas fees below $0.005 on v2, users will benefit from even lower trade execution costs.

Bluefin Today

At Bluefin, we are building a decentralized orderbook-based exchange for both professional and first-time traders. Bluefin v1 supports the trading of perpetual swaps and is currently powered by Arbitrum, a layer 2 blockchain leveraging the security of Ethereum. To this day, v1 has processed over $1 billion in trading volume. With the next version of the exchange, we want to build a decentralized platform that can match the features and trading experience of centralized exchanges. This includes supporting new features such as spot trading as well as overcoming the performance limitations and high gas fees on existing Layer 2s. As this next iteration of the exchange is rolled out, we will continue to operate and maintain Bluefin v1.

Bluefin v2

We are now excited to announce Bluefin v2. Over the course of this year, we’ve rewritten our codebase and built on a new underlying technology. Bluefin v2 is built on Sui, which enables horizontally scalable performance and a wallet-less trading experience that competes with the user experience of a centralized exchange. With Bluefin v2, we introduce

- Optimistic trades streamed sub-second and eliminating the need for wallets.

- Spot trading using Sui’s on-chain orderbook, further enhancing our decentralization, transparency, and security.

- A new margining engine with cross-margining capabilities.

- An underlying layer 1 that has seen a peak throughput over 5400 TPS on mainnet and a peak throughput ranging from 10,871 TPS to 297,000 TPS while benchmarking in a series of tests.

Performance

Our goal is to ensure that users experience sub-second trades, finalized on-chain, and reflected instantly on their UI. These are two key performance components of Bluefin v2: optimistic trade confirmations and on-chain finality.

Because Sui does not require a total ordering of all transactions (only a relative ordering of causally related transactions), it supports parallel execution and the availability of the network is not constrained by other applications and users. As a result, the success rate for valid transactions submitted on-chain is extremely high. Building off this guarantee, we’ve redesigned the off-chain orderbook layer to start sending optimistic confirmations of trades in ~30ms back to users. This occurs before on-chain execution, and we’re able to ensure eventual consistency with the on-chain smart contracts.

Owned object transactions on Sui achieve finality in ~480ms, and in the benchmarking of a real trade in a production setting, we observed an average end-to-end trade confirmation of ~510ms (including network latency between our orderbook and a Sui full node). The eventual consistency between the optimistic trade confirmation and on-chain trade execution is achieved within this time period. Accounting for matching and client network round trips, the GUI is updated with the trade result in under a second.

Sui is currently able to achieve over 5400 TPS on mainnet, with benchmarked peak throughput ranging from 10,871 TPS to 297,000 TPS and time to finality of ~480 milliseconds on a network of 100 globally distributed validators. [1]

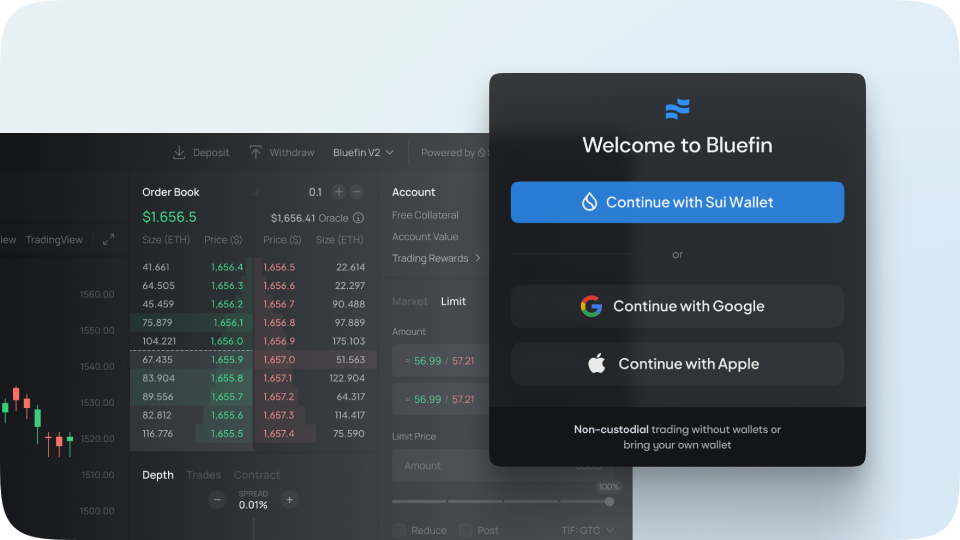

Eliminating Wallets While Remaining Non-Custodial

We’re working on eliminating the need for users to bring their own wallets by making on-chain interactions invisible to users. Abstracting away private key management and the need for wallets altogether, while remaining non-custodial, is a key milestone for decentralized finance. We’re excited to do this with the largest use-case in Web3 today: trading.

Phase I - Social Log-In & No Private Key Management

We're building out an integration with zkLogin an exciting new native authentication primitive on Sui that allows users to connect their accounts using familiar web2 logins, such as Google or Facebook, while leveraging zero-knowledge proofs to ensure the privacy of sensitive user data.

Phase II - One-Click Deposits, Direct On-Ramps, Direct Transfers from CEXs

Our goal is to have users able to trade within a few minutes of accessing the exchange — comparable to our centralized competitors. This means that on top of abstracting away the need for wallets, we need to make the onboarding of assets as easy as possible. For existing DeFi users, Bluefin will enable one-click deposits of assets from any chain using a cross-chain messaging protocol. For those who are new to Web3 or who trade on Binance & other CEXs, we will support direct fiat on-ramps and direct deposits from other CEXs.

Phase III - Eliminating The Wallet

Ultimately, we want to eliminate the need for Web3 wallets altogether. With the addition of an asset-centric transaction format, encompassing sponsored transactions and programmable transaction blocks, users can bypass the need for wallet installations. This means a swifter, more user-friendly, and secure trading experience without sacrificing technical integrity.

Launch Plan

We will be releasing v2 features on a rolling basis over the course of the next 6 months, however, an early version of the protocol will be available later this month. The early release will not include all of the above features, but will make us one of the first platforms to support derivatives trading on Sui.

Alongside the key features above, we will focus on keeping Bluefin v2 robust via a series of phased rollouts, including a Developer Testnet, Public Testnet, Bug Bounty Program and finally a Beta Mainnet. We’ll also look to launch numerous markets on v2 in collaboration with our partners, introduce fee tiers, and also support a mobile trading application.

Security and Audits

Our approach to security is anchored by the non-custodial design of our exchange, a transparent on-chain margining engine, and a commitment to ensuring no centralized risk for users — by ensuring that any network we build on has a sufficiently decentralized set of validators, and by providing users with options to trade without the centralized orderbook.

We believe that transparency and security are of the utmost importance, and as such have partnered with the following teams leading up to the release of Bluefin v2:

- A full protocol audit from Trail of Bits

- Real-time threat monitoring via Guardrail

- Immunifi bug bounty program - inviting the global developer and security community to rigorously test and validate our on-chain protocol

We also benefit from the exceptional security and decentralized governance of the Sui network. Validators are periodically elected by users locking and delegating their SUI tokens, ensuring no central entity controls the network. This Delegated Proof-of-Stake model, combined with Byzantine fault-tolerant protocols, allows the network to remain secure and operational even if some validators act maliciously or go offline.

Reach Out

We will be releasing more information and documentation over the next few weeks. If you are a professional trader or firm and are interested in integrating with Bluefin v2, please fill out this form.

To get involved and stay up to date:

- Trade on Bluefin

- Join the community on Discord

- Follow us on Twitter