Exchanging digital assets, such as tokens and NFTs, is the single most popular use case of blockchain today. In the crypto trading sector, perpetual swaps particularly outweigh the spot and NFT markets in terms of daily trading volumes. Currently, close to 100% of perpetual swap volume flows through centralized crypto exchanges (CeFi), where the execution is opaque, and user funds are at the provider's mercy.

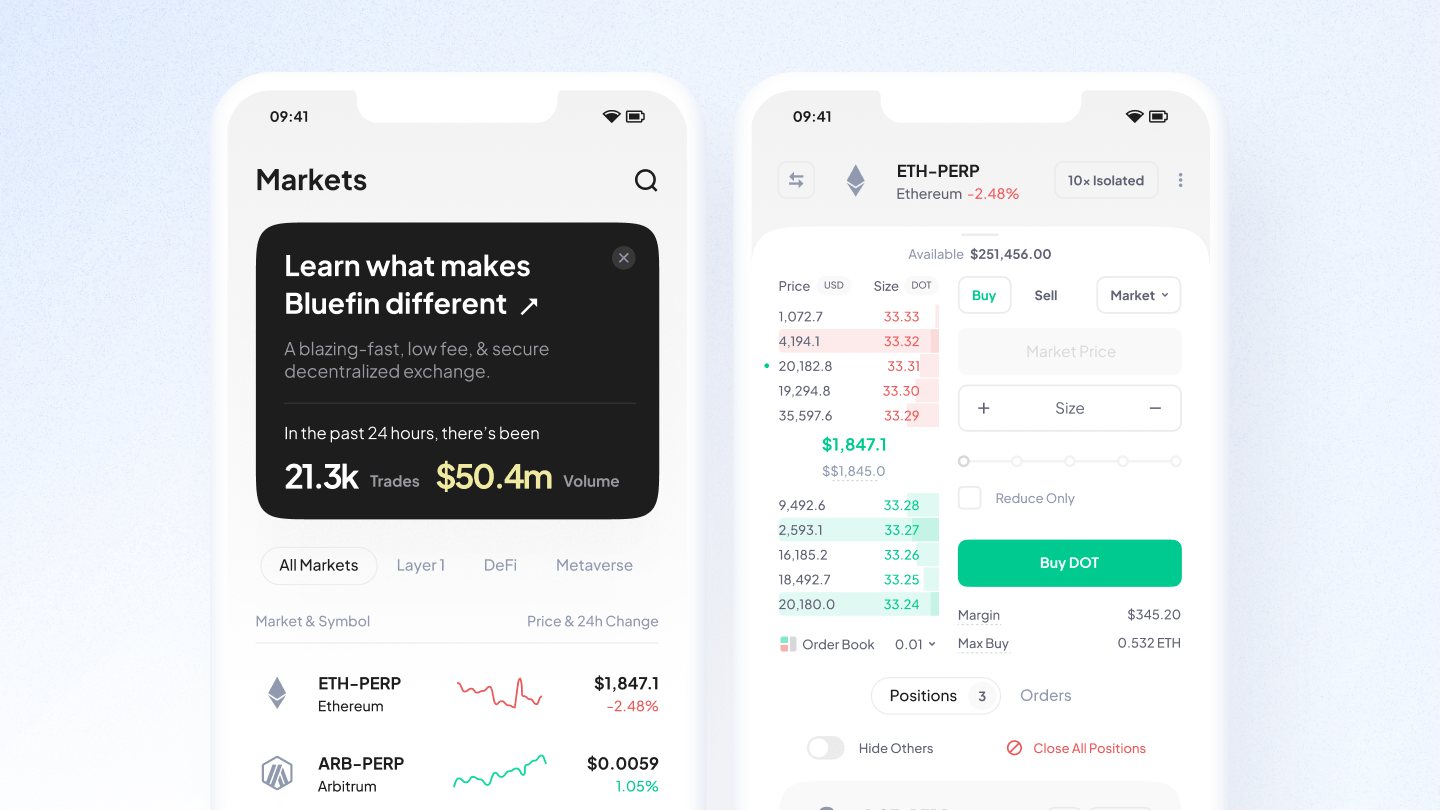

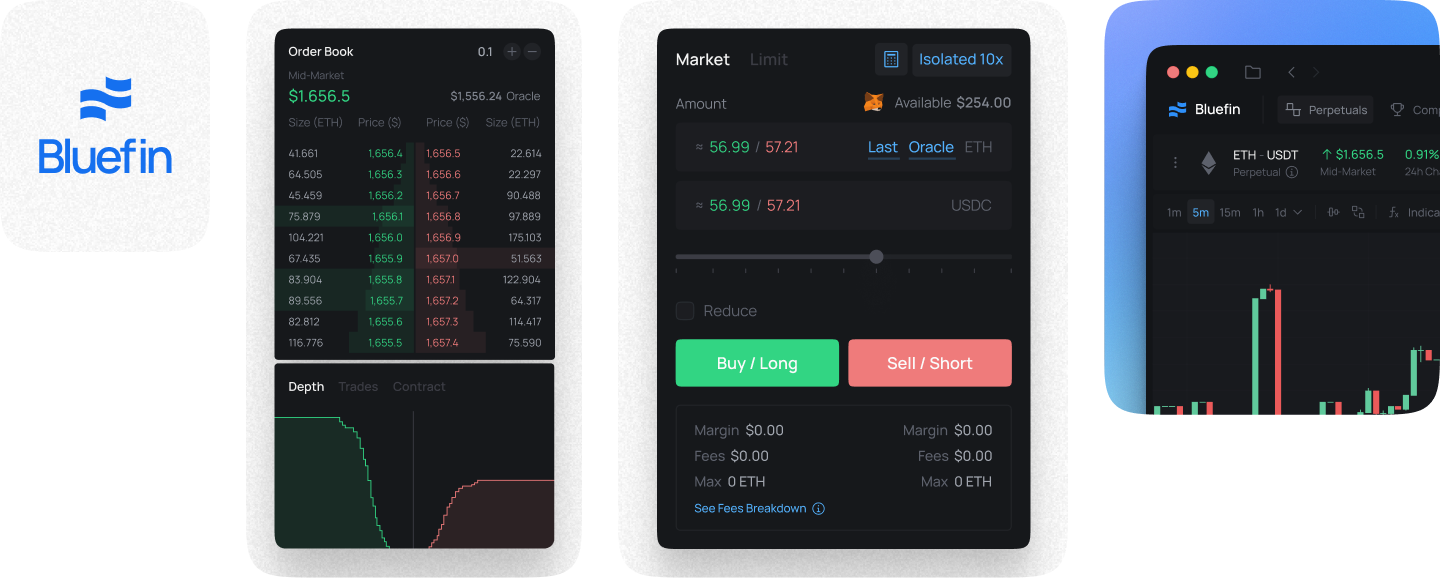

However, with advances in blockchain scaling and bridging, more progressive projects are possible. As such, Bluefin is a Web3 protocol for asset exchange, combining the performance of CeFi with the benefits of decentralized finance (DeFi). Initially targeted at the perpetual swap market, Bluefin protocol is extensible and customizable, designed to keep pace with the innovation and market dynamics in the digital assets space.

An Extensible, Customizable, & Upgradeable protocol

The on-chain, decentralized governance can upgrade all smart contracts of the Bluefin protocol. Decentralization will permit a wide variety of financial products to be added to the protocol -- from perpetual swaps to options, spot, NFTs, and financial experiments.

Non-Custodial

Deposits and withdrawals on Bluefin happen via smart contracts without limits or restrictions. Traders interact only with non-custodial and transparent smart contracts, and no central party has any control over funds and transactions. The best auditors have confirmed the correctness of Bluefin's non-custodial smart contract logic.

Permissionless & Accessible

The interaction with the core exchange happens directly on the blockchain, making accessing markets fast and easy, with only a Web3 wallet required. The exchange will also be available from a dedicated mobile application via an imported MetaMask wallet for even speedier access.

Value Flow to Traders

Not only are fees on Bluefin competitive with those on centralized exchanges, but they will also be a part of the on-chain smart contract design. In the future, the fees collected by the protocol can be used to reward the most valuable traders utilizing the protocol.

Transparent Liquidations

Liquidations in CeFi are a black box, with little to no transparency and verifiability. The liquidations on Bluefin are transparent -- each liquidation is verifiable on the blockchain, with data such as the entry price, index price, size, and the liquidator openly available. Anyone will be able to become a liquidator on Bluefin.