Our Journey with Bluefin Classic has been remarkable, and we thank all of our early users and the

Arbitrum ecosystem for their trust and support. As we wind down this chapter, we encourage our users to

manage their positions as required (more details here). The focus now shifts to Bluefin v2

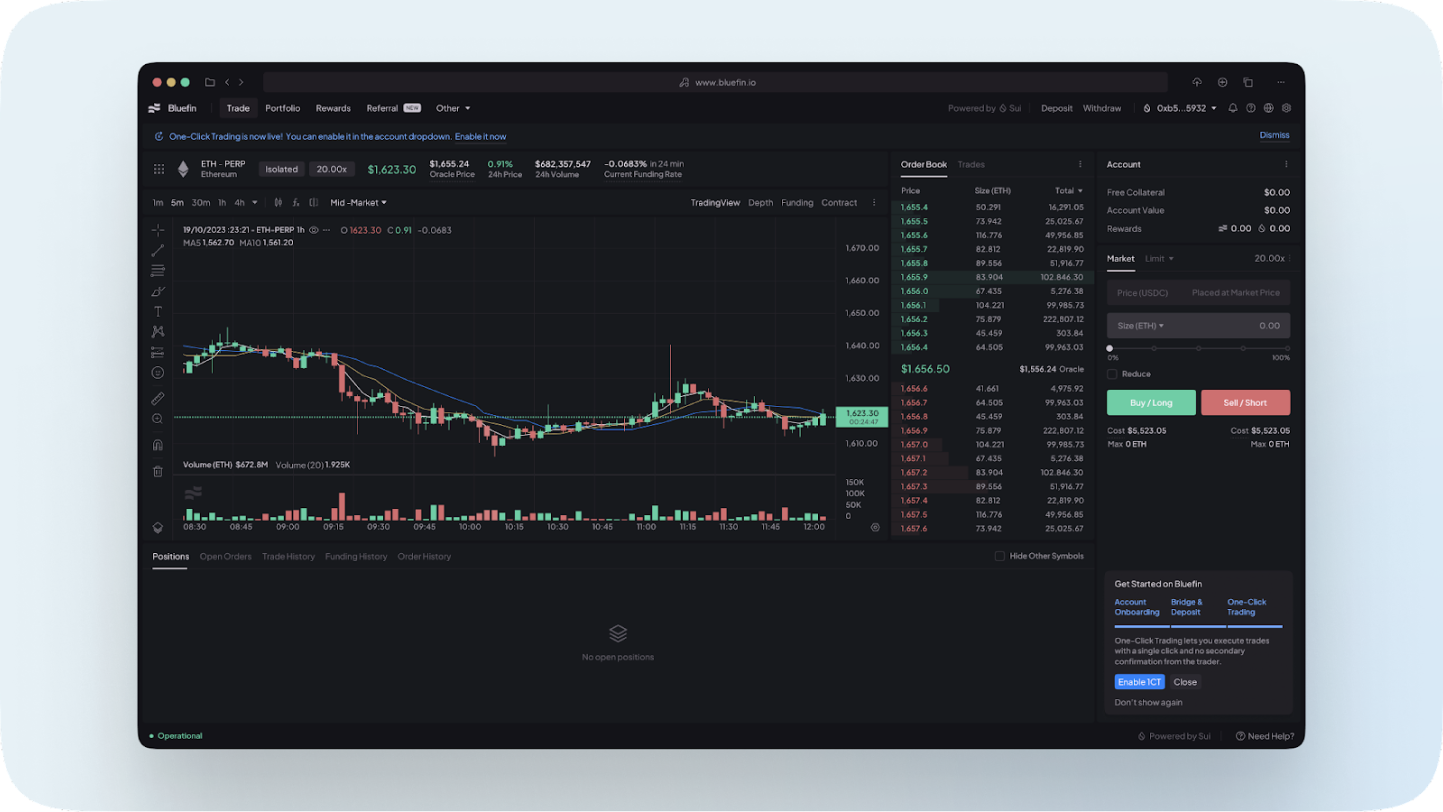

powered by Sui, where we aim to offer traders a more performant, low-cost, and Web2-like user

experience - as we announced earlier this

year. Here’s what’s been achieved

since the launch of v2:

- Growth in December: $103M/day in average volume, 80%+

DEX market share on Sui - Performance: ~550ms finality, 5,400+ peak TPS

- Eliminating Wallets: Users only need a Google account to sign up and trade

- Lower Cost of Execution: Gas fees are below $0.005 on v2, and

currently

fully-sponsored by the Bluefin Foundation

Sui’s performance and focus on user experience align with our priorities as we continue to build a platform for both professional traders and first-time users. Given that we've seen liquidity and volume scale very rapidly on Bluefin v2, we will be winding down Bluefin Classic and focusing on releasing new features and upgrades on Sui.

What’s Coming Up In Q1, 2024

Since its release in September, Bluefin v2 has processed over $2.3 billion in trading volume. We want to build a platform that can compete with and capture market share from centralized exchanges - and Sui enables us to do this. This includes supporting new features as well as overcoming performance limitations and user experience friction:

Expected in Early February, with rolling milestone releases earlier

- Account Abstraction: zkLogin, Walletless, Built-in Bridging, 1 Click Trading - Users only need a Google account to sign up and trade. No wallets are required. This enables us to unlock the security benefits of decentralized trading to the border cryptocurrency derivatives market

- Enhanced Retail UI - Redesigned UI Web & Mobile Friendly, Immediate Position Updates, Chart order & position indicators, New depth chart, Integrated funding rate chart, Market & Index candles, Notifications

Expected End of March

- Breakthrough Performance & Cross-Margining - 30ms Trades, Cross Margin, Isolated Sub Accounts, More Markets - as a result, users can receive trade confirmations within 30ms, and can validate their trades on-chain within 550 ms. Because of parallel execution (throughput currently scaling over 5400 TPS), there will be minimal lags during extremely volatile market conditions unlike most Ethereum L2s

Redefining the On-Chain Trading Experience

As mentioned above, Bluefin is going to redefine the experience of using on-chain trading platforms through performance and usability - by early next year, we hope to have made significant progress towards this goal. We look forward to sharing more updates along the way!

To get involved and stay up to date:

- Trade on Bluefin

- Join the community on Discord

- Follow us on Twitter