A proposal from the Bluefin Foundation

The platform and BLUE are not available in the United States or other restricted jurisdictions.

The Bluefin journey reflects that of resilience and innovation. With the support of our core contributors and investors, we're excited to put a product into the hands of the community that powers the next generation of on-chain trading.

We spent the better part of a year heads down, building, knowing that together we’d be able to overcome any challenge that came our way. The team centered itself around the values of continuous learning, clear communication, positive energy, and efficient execution, believing that this would allow us to deliver a groundbreaking product.

Our journey has brought us to this point where we now look to advance our mission of building a new financial network.

Ownership of the Bluefin protocol will now extend to the entire community and we’re confident that your passion and commitment will see Bluefin become a foundational piece of Web3 moving forward.

Suffice it to say, building an exchange and a company has not been an easy task. Like others in the web3 ecosystem, Bluefin has weathered many storms and setbacks. This protocol is tried and tested, and has achieved success in large part due to the backing of investors and partners, a talented team of core contributors and support of the community.

Bluefin has consistently seen centralized exchanges, like Binance and Upbit, as its primary competitors, despite being a blockchain-based platform. This unique focus distinguishes Bluefin in the market. Their unwavering commitment to setting exceptionally high standards is evident in their prioritization of UI/UX design.

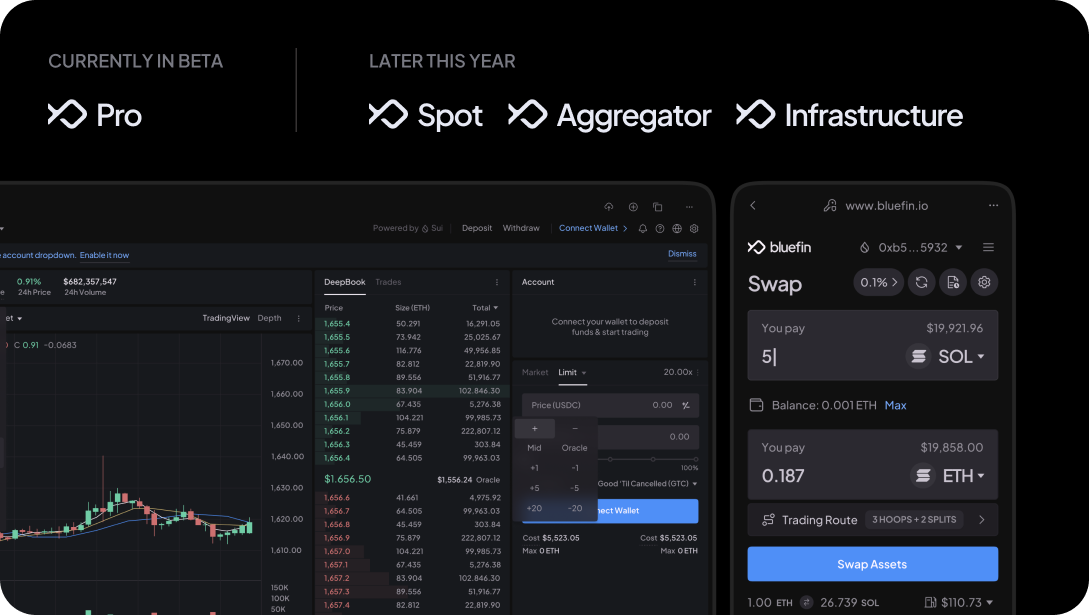

Bluefin is building a financial layer, starting with perpetual, spot, and optimal routing - and built on a high-performance chain for scalability and usability. The platform has great liquidity with the support of key market players and has a committed team with a long-term vision. We’re actively deploying our strategies on Bluefin, and are excited to support Zabi and team!

Having met the team on multiple occasion and as the analytics providers for the Sui network alongside Bluefin, we see Bluefin being one of the most promising applications on the network so far.

Many Individuals have incorrectly written off new Blockchains without understanding the magic these new ecosystems offer. Today's Podcast sets out to break that Myth. I'm launching my first podcast with @SuiNetwork breakout application @BluefinApp, which did over $4 Billion in monthly trading volume.

Bluefin has built a solid decentralized exchange that addresses real needs in today's on-chain trading environment. It's fast and efficient and opens up the digital asset derivatives market to a broader audience. Our role in providing liquidity aims to solidify a dependable trading experience, a timely move as Bluefin advances to its next phase.

The firm has shown a strong commitment to the adoption of on-chain value by combining a scalable, high-performance exchange with a UX that abstracts the blockchain’s intricacies to allow wallet-less trading. We’re confident this partnership will support the adoption of on-chain trading.

The Bluefin team has done a fantastic job creating a trading user experience that is silky smooth, and has impressed us with their steady and consistent focus on improving even further and thinking outside of the box .

Bluefin's team and product have both been a pleasure to work with. They stand out as one of the most efficient venues on which to trade on-chain. We are proud to contribute to Bluefin's user experience through our continued partnership with them to provide liquidity to Bluefin traders.

We had a great working relationship with Rabeel and his team on their orderbook trading infrastructure as one of the earliest traders and design partners. The team focused on providing a superior institutional trading experience and we look forward to a long-term partnership with them.

We at Cryppro take pride in providing innovative solutions and delivering value to our partners, from product design to market strategy and pricing. We are delighted to witness the substantial growth that Bluefin has experienced recently, and we remain committed to contributing to their continued success

The Bluefin team is laser focused on building a great trading experience and we are super excited about the innovations in Bluefin v2. Really glad to be working with Rabeel and his team and we look forward to a long and fruitful partnership!

It’s exciting to see Bluefin bring a transparent, efficient and elegant solution to the derivatives market, which will support the surge in demand we are seeing in both traditional and cryptocurrency markets

First steps towards decentralization.

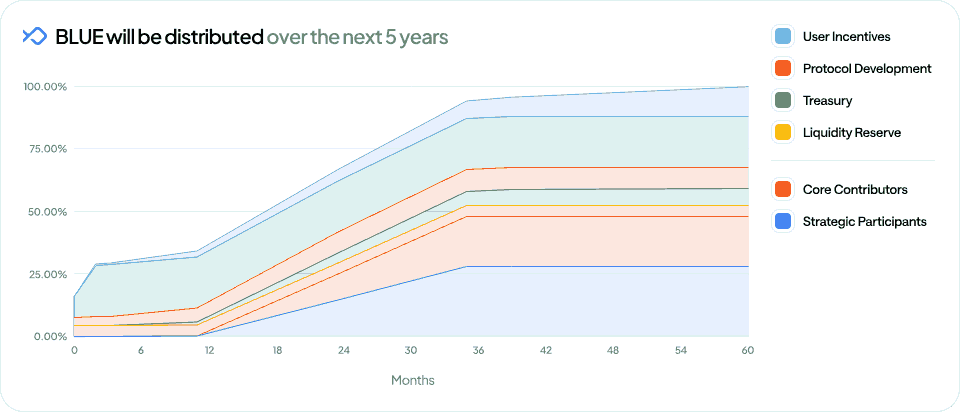

The upcoming token generation event (TGE) and initial BLUE distribution are important steps toward a decentralized governance model. Bluefin's strategy is designed to align incentives across users, contributors, and stakeholders, ensuring long-term ecosystem growth and platform integrity.

Fully unlocked after 5 years

This portion of the allocation supports long-term growth of the ecosystem and rewards users and supporters of the platform.

Vested over 5 years

19.68% for the Bluefin Airdrop which will be given to early point holders and new users. A portion of this will be available at TGE, while the rest is unlocked over a couple months. Any unclaimed amounts will go back to the Bluefin Treasury. There will be a separate blog on the Bluefin Airdrop.

12.82% for post-launch incentives that reward trading, liquidity provisioning and future growth initiatives

⅓ at TGE, ⅔ over 2 years

This portion of the supply is allocated to the Bluefin Foundation’s reserves. Priority initiatives include contracts with service providers like OpenBlock Labs & Chaos Labs, exchange listings, strategic partnerships with DAOs and communities, protocol security, liquidity needs, capitalizing the insurance fund, and operating expenses. The Foundation Transparency statement can be found below. The unlock at TGE is primarily needed for exchange listings and launch pools.

3 month cliff, 36-month vesting

This fund is managed by the Bluefin DAO, allowing the community to allocate resources in a way that aligns with Bluefin’s goals and priorities. It acts as a financial backbone, ensuring the long-term sustainability and scalability of the project.This supply unlocks linearly over 36 months, beginning 3 months after TGE.

Unlocked at TGE

This portion has been reserved for liquidity at launch. 2% of the supply will be given to market makers to quote on centralized exchanges, and about 2.5% of the supply will be used for DEXs and cross-chain liquidity. This entire allocation will unlock at TGE and will be a part of the circulating supply.

3 year vesting, 1 year cliff followed by a 24-month linear unlock

This portion of the supply has been allocated to investors via private sales and advisors. These stakeholders have a long-term vested success in the success of Bluefin, and include leading VCs and quantitative trading firms. None of the supply is unlocked at genesis. Tokens will be released linearly over 24 months, commencing 12 months after TGE.

3 year vesting, 1 year cliff followed by a 24-month linear unlock

This allocation represents Core Contributors, who have supported the engineering, infrastructure, security, growth, and operations of the Bluefin Protocol. None of the supply is unlocked at genesis. Tokens will be released linearly over 24 months, commencing 12 months after TGE.

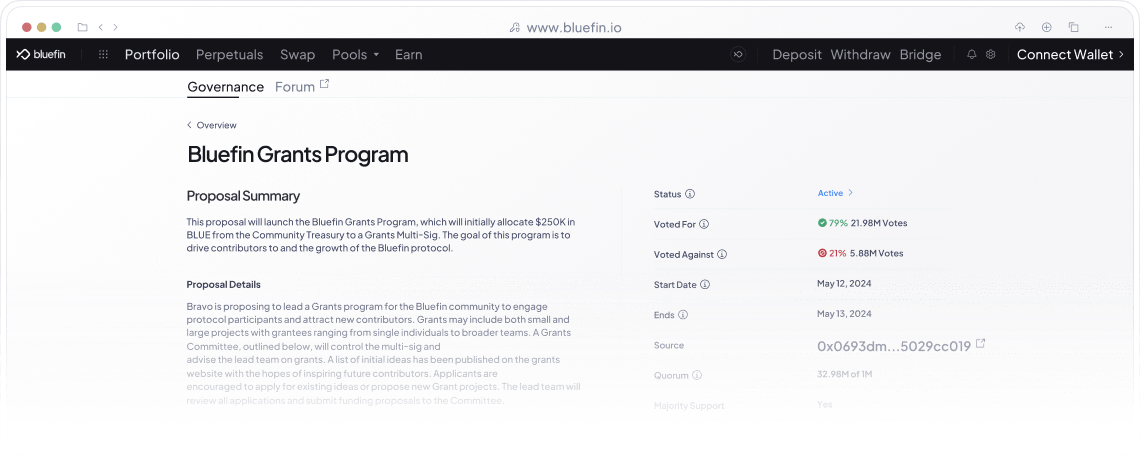

Once Governance goes live, users will have a direct say in key decisions such as protocol upgrades, fee structures, and asset listings. Over time, the DAO will continue to take more responsibility for decisions impacting the protocol.

Voting power will be determined based on the number of tokens you decide to lock into a proposal. The voting process starts with a forum discussion and is then followed by an on-chain vote on the Bluefin Governance portal.

How can community members acquire the Blue token?

Community members will be able to acquire the Blue token by:

1. Directly engaging with Bluefin protocol by trading on the exchange, referring new users or participating in low-risk stable pools.

2. Purchasing Blue on exchanges that list the token.

Note: Blue is not available to residents of the United States. Please view our terms of service for a full list of restricted territories.

What is the Blue token standard?

The Blue token will be natively on Sui.

How is the Blue Airdrop allocated?

19.68% of total Blue supply has been allocated to the Bluefin Airdrop program, which will be given to early point holders and new users.

Approximately 13.18% of total supply will be distributed to early protocol participants who have directly engaged with the Bluefin exchange.

Up to 6.5% of total supply will be distributed to Bluefin Leagues and new community members composed of:

Sui partners and contributors who have demonstrated interest in growing the ecosystem

Protocol partners who have engaged with critical integrations and infrastructure that power Bluefin

Community partners who resonate with the Bluefin vision and will provide direction and value as Blue holders

Lastly, in order to drive protocol adoption, users who have contributed to decentralized trading across web3

What does the claiming process look like for initial recipients of Blue?

Users have been accumulating tokens through various campaigns throughout Bluefin's history (Trade & Earn, Stable Pools, LPing on Spot, etc.). These tokens form part of the user's "Historical Points" and 80% of them will be claimable at TGE. The remaining 20% will be unlocked in the following 2 months (10% each month).

The other part of the tokens unlocked at TGE will correspond to the Bluefin Airdrop. Users will be able to claim 50% of their airdrop allocation at TGE and the remaining 50% will be unlocked in the following 2 months (25% each month).

Tokens will be able to be claimed directly through the Bluefin exchange.

What will be the utility of Blue?

At launch, the primary utility of Blue will be to drive governance of the Bluefin Protocol. This means that Blue holders will be able to propose and vote on key protocol decisions. Only through on-chain governance will the Bluefin Foundation introduce further utility functions of Blue, which can happen as soon as TGE occurs.

How can community members participate in governance using Blue?

Blue grants holders the right to propose and vote on changes to the Bluefin protocol. Voting power will be determined based on the number of tokens you decide to lock into a proposal. The voting process starts with a forum discussion and is then followed by an on-chain vote on the Bluefin Governance Portal.

Initial Governance Parameters will include:

Proposal Threshold: In order to submit a proposal, participants must have 10,000,000 BLUE in voting power in their account.

Voting Period: Participants will be able to vote on proposals for a period of 4 days.

Quorum: In order to pass a proposal, there needs to be majority support and more votes than the quorum (1,000,000 BLUE). These are tokens that must be locked in the contract during the voting period.

Timelock: There will be a timelock delay of 1 day - proposals will only be executed after completion of this period.

Blue holders will have immediate control over proposals such as:

Allocating community treasury funds

Launching new token listings on the Bluefin Protocol

Introducing additional token utility

Modifying or initiating incentive programs

Introducing fee tiers

Governance contracts themselves

All Blue holders are responsible for ensuring that governance decisions are made in compliance with applicable laws and regulations. The community is encouraged to consult knowledgeable legal and regulatory professionals before implementing any proposals.

Security and Audits

All smart contract code including that of the Blue token, governance contracts, and Bluefin protocol have been audited by TrailOfBits. There has been no security breach on Bluefin since the launch of the protocol.

Bluefin Foundation Transparency Statement

The Bluefin Foundation is focused on supporting and growing all aspects of the Bluefin protocol and its implementation. The foundation is committed to ensuring the sustainability of the protocol and its ecosystem. Specifically, this may include:

Developing the ecosystem of the Bluefin Protocol

a. Supporting initiatives that help ensure network growth and that help drive the network’s long-term utility.

b. Promoting the use and vision of the Bluefin protocol - funding marketing, education, and other initiatives that promote the ecosystem and/or the Bluefin protocol

c. Striking business agreements, entering into transactions or partnerships, and generally performing acts deemed beneficial, necessary, and desirable to assist in furthering the adoption of the Bluefin protocol

Supporting the security and technical development of the Bluefin protocol

a. This includes funding security audits, core protocol development, infrastructure related test and integration environments, public RPC endpoint services, block explorers, developer support, education, documentation, and more.

b. Funding the research and development of future protocol improvements and security

Supporting the protocol’s liquidity

a. Loans & liquidity allocations to Market Makers of the BLUE token

b.Liquidity to list market pairs on the exchange

c. Foundation may sell part of the supply to distribute ownership and build a stablecoin supply that can be used for providing liquidity to the protocol — both as loans to market makers or directly supplying liquidity to on-chain programs.

Capitalizing and managing the Bluefin Insurance Funds

Issuing, holding, receiving, and spending digital assets and fiat assets for the purposes outlined above (no speculative trading activities)

Initiating DAO governance smart contracts and issuing governance tokens

The Bluefin Foundation may liquidate BLUE from time to time when expenses cannot be paid in BLUE. When undertaking this activity, the Foundation will adhere to the following guidelines:

a. The seller only makes offers at or above market price, and doesn’t sell into bids.

b. Daily sales remain materially below a fixed amount determined by medium-term volumes (while remaining below 5% of estimated real market volume on any given day)

The platform is not available to United States residents. Please view our terms of use and privacy policy before accessing the platform.